As the year draws to a close, I have started my annual financial review and goal setting process for the year ahead. This is an important step in any financial planning. For me, the exercise helps me determine where my family’s finances stand and if adjustments are needed. It also gives me a clear picture of our current accounts and helps my partner and I set goals.

Annual Financial Review

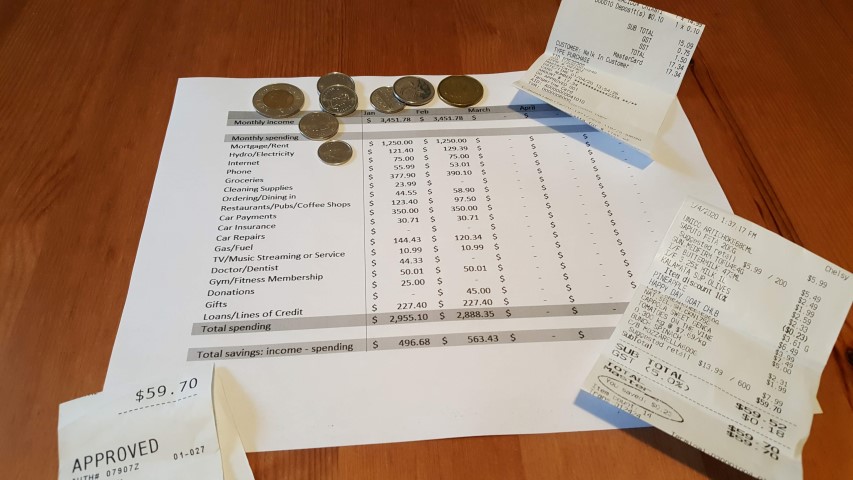

First, I analyze our actual spending against the budget I made at the start of the year. As the year rolls along, we track our spending and fill out our income statement each month. Now that the data is in, it’s time to quantify! Though everyone has a different way of tracking their spending, I personally use good old Excel. My Excel template can be found on the Free Financial Resources page for any who may be interested.

Doing this helps me see where my family overspent, underspent, and how realistic our budgeting assumptions were. This year, for example, we spent more than I had expected on groceries, but way less on travel, vacations, and meals out. The Covid-19 pandemic really shifted our spending habits. This process shows me how much my family saved as well. Seeing how much you actually saved versus what you were hoping to save is key because it will help you build realistic budgets in the future.

I then build a balance sheet on January 1. This gives my partner and I a snapshot of our net worth. This measures how much money we have (i.e., assets – liabilities = net worth). It also highlights our liquid net worth and gives us an idea of how much cash we could access in a pinch. Here too I use Excel (again available on the Free Financial Resources page).

I will then turn my attention to my family’s investment portfolio. You always want to monitor your investments. Therefore, an annual review will be worthwhile regardless of if you are a DIY investor or have hired a professional. Personally, I take this opportunity to make sure I am comfortable owning what is in my portfolio, checking if I’m diversified enough, etc. You can read more about this process here. I then assess how much we paid in trading costs, annual fees, and taxes. If you’re new to investing check out this post for more details on exactly what you should consider.

Finally, I will estimate my family’s upcoming tax bills (or refunds), and make sure our will and power of attorney documents are up to date. I sometimes find adjustments are needed after another year has passed, but generally only minor changes are required, if anything.

Goal Setting for The Year Ahead

With the year in review complete, it’s time to set goals for the year ahead! The first thing I do is build a new budget. My partner and I do a top-to-bottom assessment of what we anticipate spending on everything from rent/mortgage payments and utilities to groceries and vacations. How much we allocate for each category is often influenced by how much we spent in the prior year, as well as by whether we have any specific plans or goals going forward. This is why it is critical to track your spending and conduct an annual reflection.

After building our budget, we can estimate how much we’ll be able to save, and from there we’re able to determine how we want to put our savings to work. How much, for example, do we want to allocate towards RRSPs, TFSAs, RESPs, and other investment accounts? Do we want to double up on mortgage payments or pay down other debts? Do we need to top up our emergency fund? Without a realistic budget, financial planning and goal setting like this is more or less a shot in the dark.

During this process I also think about when big expenses such as income taxes, municipal property taxes, or annual life insurance payments may be due. From there I budget for it. That way we’re not caught out unexpectedly and always the cash ready to deploy.

You may want to take this opportunity to reflect on your long-term financial goals too. Are your personal finances on track for you to buy a home, be mortgage-free, or retire? Whatever your long-term goal or goals may be, an annual review will help.

Final Thoughts

Tis the season to reflect and plan! As the year draws to a close, it’s once again time for my annual financial review and goal setting for the year ahead. Both are important steps in any financial planning roadmap. The exercise gives me a snapshot of where my family’s net worth stands after another year, and allows me to compare our actual spending to the budget we set this time last year. From there, I can see how much we saved and build a realistic budget for the year ahead. Finally provides me with the opportunity to examine my long-term goals and make sure I’m sticking to my process.

Disclaimer

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research, and seek out a professional who can work with you to reach your goals.

Great read, this is definitely helpful to keep your spending on track but also a great point, it allows you to figure out what is reasonable to allocate to TFSA, RRSP and save even more in the long run.

Thanks Family Money Saver! I’m glad you liked the article.