Personal Finance in the News – January 2021:

Welcome to Money News – January 2021! I have four noteworthy news topics for you this month.

Read: For those of you interested in stocks, this month has been bonkers, with the market ripping higher. Most noteworthily, an online community of individual investors (often called retail investors) has taken aim at institutional investors like hedge funds, with unprecedented results. This is driven largely by the online community of Reddit (in particular the sub-reddit r/wallstreetbets). Their strategy has proved simple and effective. They find heavily shorted stocks, buy them en masse with thousands of other retail investors, and promote the shares on Twitter, YouTube, Reddit, etc. This strategy forces hedge funds who have shorted to cover their positions by buying back the stock they borrowed. This sends the stocks through the roof.

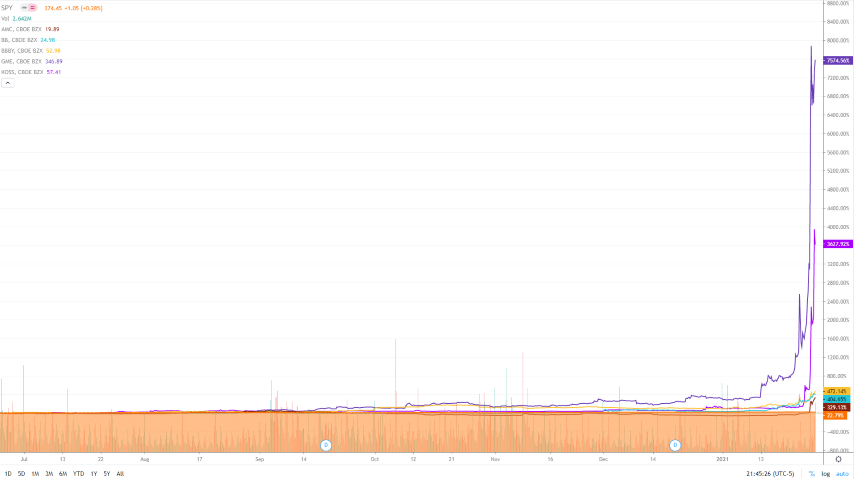

In some ways, this sounds like a classic David vs Goliath story, but in other ways it’s an off-the-rails game of Russian Roulette. So far, the most notable examples of companies flying are AMC Entertainment Holdings, BlackBerry, Bed Bath & Beyond, GameStop Corp, and Koss Corporation. As the chart above illustrates, these stocks are up between 150% and 2,700% over the last three months versus the S&P 500, which is up roughly 14%. This saga is the stuff of movies and regulatory investigations – and it doesn’t seem to be over yet.

Read: Meanwhile in Denmark, home buyers can now get a 20-year mortgage for 0% according to this Bloomberg article. In December’s Money News, I wrote about HSBC offering a 5-year mortgage here in Canada below 1%. The era of low inflation, low interest rates, and cheap debt continues unabated.

Read & Watch: According to the FP, middle-income Canadians took a hit to their paycheques when CPP premiums increased January 1. The Covid-19 pandemic’s impact on the labour market is the main reason for this. If you’re wondering why your paycheque looks a little different this year, now you know.

Read: The saga around the Canadian Emergency Response Benefit (CERB) continues. As you may recall, many self-employed Canadians are now being asked to repay sums of up to $14,000. This is because the government provided unclear wording regarding gross vs net income on the original application. According to this CTV article, the government will not forgive people, and will indeed require repayments. Once again, governments and government departments like the CRA have demonstrated how they can and do act with impunity. Furthermore they do so irrespective of the disastrous results for those impacted.

That’s all for now – thanks for reading Money News January 2021 edition! Stay tuned for more money news next month, and look out for my coming update on Tax Free Saving Accounts.

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.

Good quick summary of events! Can you imagine if you were an investor holding your sideways position in GameStop for years now and then this happens!? Cool for those people! Hopefully too many others don’t get burned badly on this one when the rugs finally gets pulled.