Personal Finance in the News – March 2022:

Welcome to Money News – March 2022! This month we look at how the war in Ukraine has impacted gas prices, Equal Pay Day 2022, and how inflation is changing people’s spending.

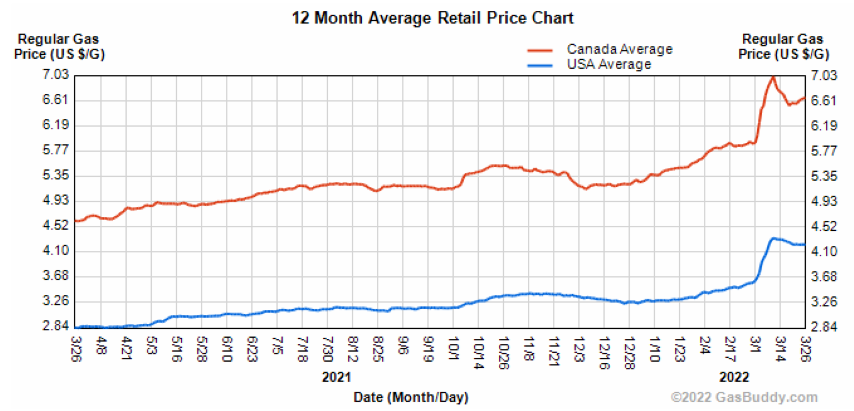

Read: The Russian invasion of Ukraine has resulted in pronounced political, military, social, humanitarian, and economic impacts across the globe. GasBuddy’s chart above shows how prices at the pump have spiked across North America. In response, people will likely find ways to drive less, use public transit or bike more, and consider an electric vehicle. This BBC article highlights other ways the war may hurt your personal finances, from higher home heating bills to surging food costs.

Read: This year, March 15th was Equal Pay Day in the US – the day that marks how far into the new year the median woman must work to attain the same pay as a median man from the previous year. Though it is better than Equal Pay Day 2021 which occurred on March 23rd, the gap remains significant. Meanwhile, here in Canada, Equal Pay Day this year will be on April 12th! Check out this Forbes article for more information on this topic and the importance of Equal Pay Day.

Read and Watch: Is inflation causing you to pull back your spending? If so, you’re not alone. This CTV article notes how Canadians are cutting back at restaurants and on groceries. Moreover, according to this WSJ article, consumers are cutting back on tips as well. People pulling back their spending is hardly surprising, with US inflation at a 40 year high around 7.8%, and Canadian inflation at a 30 year high around 5.7%. Having prices increase so fast generates a lot of sticker shock, or even dread and fear. (If you’re feeling this shock, check out my recent post on how to beat inflation).

Stay tuned for more Money News next month. Thanks for reading!

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice. It is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional.