What is Net Worth?

Net worth measures how much money you have. The formula for net worth is very easy:

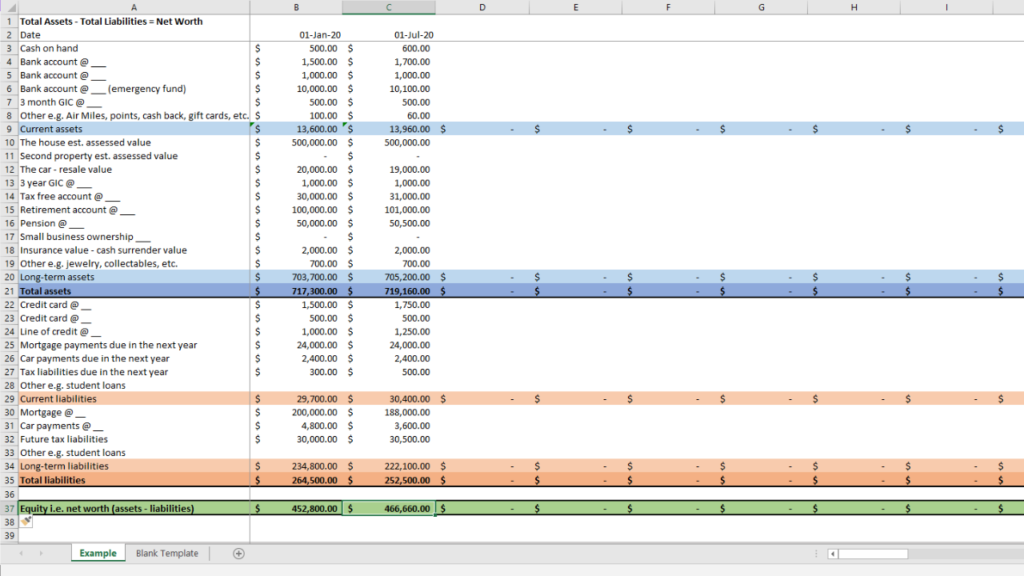

Assets – Liabilities = Net Worth

Remember, assets are things you own, and liabilities are things you owe (e.g. debt). Here’s a simple example: If all you have is $10 in your pocket, but you owe your friend $3, your net worth will be $7. If those numbers seem too small, just scale them – if you have a home worth $1 million but carry a mortgage of $300,000, your net worth is $700,000. In the corporate world, another term for this is equity which they report regularly on their balance sheet.

Why is tracking it important?

Tracking your net worth is important because it gives you a snapshot of your current finances. It will help you understand what you own, what you owe, and how you’re doing overall. From there, you can then use this information to plan, prioritize, and set goals for yourself and your finances. It will let you see where you can improve, where you’re doing well, and can help you assess if your goals are realistic.

Sometimes it can show a negative number. While this can be an issue, it’s not always the case. Many recent grads have a lot of student loan debt after graduation. If that is you, you’re not alone. Also – congratulations! You’re on the other side now.

When I met my wife, she was a recent grad and in this situation. She worked hard to pay off her student debt and shift her from negative to positive. It’s not easy, and yes, it will take time, but with diligence and prudent planning, you can maximize the impact of your hard work when repaying a loan.

Where do you track your net worth?

Though there’s lots of software out there, and some banks provide their own net worth calculators, I personally use Excel. I much prefer it, because Excel is free, easy to use, and oh-so customizable. I also have money in more than one bank, which means no single bank software captures the whole picture… and even with all the new high-tech mattresses out there, there’s still nothing with software to track the money I stash under them (JK! I like making interest on my cash at the bank).

To get you started, check out my Free Financial Resources tab – here you’ll find a simple Excel template I’ve used for years. Feel free to download and take a look, and customize it to suit your own needs.

How often do you update your net worth?

There’s no hard rule about how often you should update your net worth – it really comes down to personal preference. For example, when I was younger, I used to update mine every month, but that got old fast! Meanwhile, my dad updates his each quarter, and these days I update mine every six months. I also know people who update it once a year. No matter what time frame you decide on, it’s important to stick with it so you can watch your financial picture evolve and see how you’re doing over time.

Final thoughts:

Net worth measures how much money you have overall, and it gives you a snapshot of where your finances stand today. Using this information, you can prioritize different objectives and set financial goals.

Though there are many resources you can use to track your net worth, I personally use Excel. You can find an Excel template here on the Free Financial Resources tab. If you build out your own Excel sheet will also get a sense of your liquid net worth which is a whole other – yet equally important – topic.

Once you’ve built your own Excel template, see how it all fits into a bigger financial picture and check out the keystone post: Seven Financial Rules I Live By. Also, consider subscribing to receive more free financial content.

Disclaimer:

Please keep in mind I am not a financial advisor and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.