Intro

Investing is a broad and far-reaching topic, and one that can be completely overwhelming for beginners. Over the years, I’ve had so many friends and family members ask me how to get started. In this piece, I’ll try to break it down for you, and share the steps that I went through myself. What follows is a summary of what I like to share with those thinking about taking the plunge, or with new investors interested in exploring further.

Put Financial Planning First

Many people start with the idea that investing should be their first financial priority. It sounds exciting, and everyone seems to know someone who struck it rich investing – but in reality, investing before addressing other financial areas is like putting the cart before the horse. Before investing, you need to make sure your finances are in solid shape. If you’ve read this blog before, I’ll sound like a broken record here, but let me say it one more time: the first steps to financial security are to build a budget, track your spending, and determine how much you’re saving. Until you take these steps, you will never be able to make wise investment decisions. Alternatively, if you know the basics check out this post on how to Make the Most of Your Investments.

After budgeting, build an emergency fund and pay off your debts. If you decide to invest prior to these steps, you may easily be paying more in interest than you’re making investing, or could be forced to sell investments prematurely to cover unexpected expenses or make debt payments. All of this could well make you poorer than you would be otherwise, especially if you’re forced to sell at a loss. By contrast, if you build an emergency fund and manage your debts first, you’ll be able to stay invested without worrying so much about a job loss, economic downturn, or unexpected expenses.

Bottom line – investing is important, but to do so successfully, you need to address your other financial priorities first. This is why investing is my last rule in the Seven Financial Rules I Live By.

Learn the Lingo

Once you have a strong financial foundation, you can proceed with confidence and step into the wild and wonderful world of investing. Be warned though – as you do, you’re likely to encounter a number of new financial terms and jargon. Sadly, there’s no way around it – to invest successfully, you’ll need to learn the lingo.

Thankfully, there are many sources available to make the process easier. When I started reading investment books, I’d keep my computer handy, and when I came across a term or concept I didn’t understand, I’d start by visiting Investopedia. This is one of my favorite resources, as it provides clear financial definitions and is a wealth of information. Through the rest of this article, I’ve linked financial terms back to Investopedia for your convenience.

In addition to reading books and using Investopedia to clarify the basics, I watched business news, explored other investment websites, and talked with industry professionals. This combination worked well for me then. If I were to do it all again today, I’d likely be doing even more learning online because the great resources available on the web these days.

As you survey the investing landscape, different types of investments you may come across could include stocks, bonds, ETFs (exchange traded funds), mutual funds, pensions, REITs (real estate investment trusts), hedge funds, GICs (guaranteed investment certificates), commodities, options, crypto-currencies, and insurance. Each of these different types of investments has distinct benefits and drawbacks – click on the links to find out more. The big two you should understand are stocks and bonds, as they represent the foundation for many other investments.

Understand the Different Investment Strategies Out There

In addition to learning the lingo, aspiring investors will come across many different strategies, philosophies, and timeframes. If you still feel overwhelmed when you get to this stage, don’t worry – it will get easier. Try to look at the number of options as a positive, because ultimately it means that there can be a good fit for everyone, no matter your starting points or priorities.

One common strategy is to hire a professional and have them invest for you. If you want guidance, don’t have that much time to commit to investing yourself, or just have limited interest in handling the details, hiring a pro can be a great option. On the other hand, you can also choose to become a “do-it-yourself” investor. If you like doing your own research and want to manage your own portfolio, this may be the way for you.

Investing is full of different philosophies as well. The efficient market hypothesis, for example, argues that the market cannot be consistently outperformed because current prices reflect all available information. Investors who follow this hypothesis often consider themselves passive investors. This means that they don’t aim to generate returns in excess of what the benchmark produces. Instead they index, essentially meaning that they buy diversified funds as opposed to a handful of stocks. In doing so, they hope to make similar gains to the increase in the market over time.

On the opposite end of the spectrum are people who believe the market is inefficient, and therefore can be beaten. Investors who follow this philosophy consider themselves active investors. They try to pick winning stocks, bonds, or portfolio managers. Active investors can be broken down into different groups and may characterize their strategy as being growth or value oriented. Active managers may bias towards technical analysis (a focus on trading activity, price history, and charts) or fundamental analysis (a focus on business results and financial ratios). There are also investors who do a mix of active and passive, growth and value, or fundamental and technical analysis.

Different investment timeframes are common too. Helpfully, most of the timeframes describe their holding periods well and are self-explanatory. Day traders, as you may expect, trade daily, while buy-and-hold investors generally hold for year or more.

The main point is that there are many different ways to invest, and there is something out there for everyone. The trick is to accurately understand the risks involved, and from there to find a strategy to suit your style.

Understand the Risks Involved

No matter how you choose to invest, you will encounter risks. Risk cannot be removed – it can only be transformed. It’s up to you to determine which risks you want to take and those you want to avoid if possible. To stay out of existential trouble, remember the golden rule:

Only invest what you can afford to lose.

If you follow the golden rule, you should be able to survive and stay in the game long enough to address the risks outlined below.

The Big Risks

Volatility (i.e. large and rapid price changes) is probably the biggest short-term risk investors face. In this case, the short term means a few months or years. Markets crash, economies enter recession, and it may take time for assets to recover. Volatility is risky because it scares people. No one likes watching an investment fall by half (or more) in a few months, and oftentimes people will panic and sell near the bottom. Nearly all of us buy when we should sell, and conversely, sell when we should buy. However awful it may feel, it can be a better strategy to hold investments through volatility and ADD to them rather than selling!

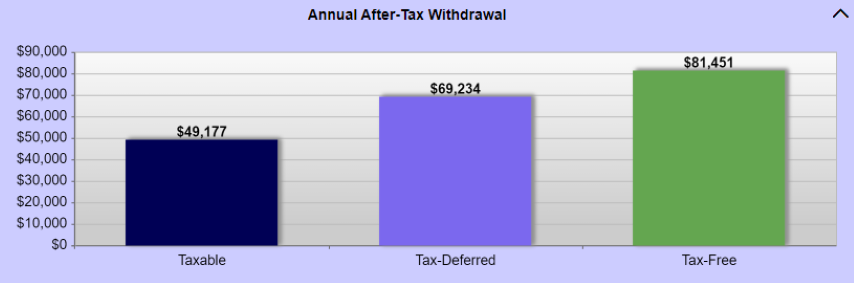

Looking at the longer term, there are three even bigger risks. The first one (dun dun duun) … is taxes! The graphic above illustrates what happens to an initial investment of $10,000 across three scenarios assuming growth at 7% a year for 30 years. In a taxable account (called a non-registered account), you end up with $49,117. In a tax-deferred account (called an RRSP) you end up with $69,234 (assuming your tax rate drops in retirement). $69K isn’t bad, but it’s still nothing when compared to the $81,451 generated using a tax-free account (called a TFSA). The lesson here? Tax plan, understand your tax options, and research the features associated with each account type. (Note – the account types above are Canadian options, but there is a similar range of options in the US under different names, as well as in many other countries).

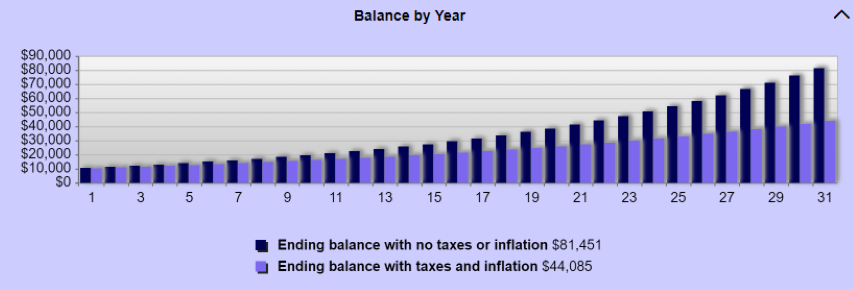

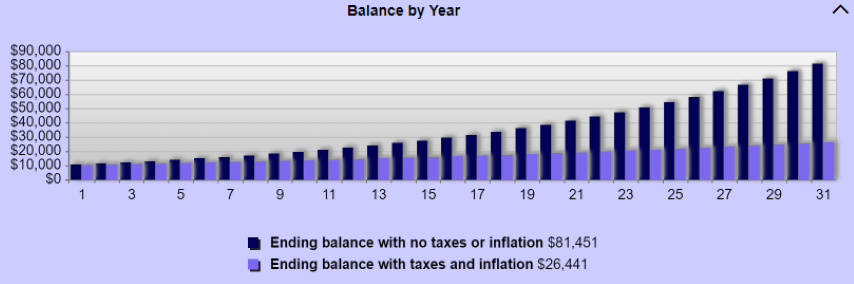

The second big risk is inflation. The graphic above illustrates what happens to that same $10,000 at the end of 30 years if the rate of inflation is 2% and your rate of return is 7%. As you can see, inflation means that your funds with a value of $81,451 will actually buy you only $44,085 worth of stuff – ouch! Furthermore, this is assuming you’ve used a tax-free account. With taxes, your money will only buy you $26,441 in goods or services.

The lesson here is to think about the return you are generating in relation to inflation. One of the biggest disservices you can do to your future self is to invest (or save) in a way that will leave you poorer than you would have been had you just spent your money instead.

The final big risk is fees. As with inflation, the higher the fees, the lower your returns. The inflation charts above could just as easily apply to fees. As a result, if you can choose between two nearly identical funds, go with the cheaper one. The impacts on your long-term wealth will be no different than the inflation charts. Unfortunately, getting to the bottom of how much funds charge can be difficult. Some funds and brokers try to bury fees, or will reduce certain fees only to increase the costs elsewhere.

Common Rookie Mistakes

No article called Investing for Beginners would be complete without a summary of common rookie mistakes. Here’s an overview:

Concentration risk: Sometimes new investors pour their savings into two or three stocks – often a commodity like gold, or even cryptocurrencies. Rookies risk blowing up if even one of their stocks goes belly up (let alone all of them). Instead of putting all their eggs in one basket, new investors should spread out investments and practice diversification.

Lump-sum risk: This occurs when someone puts all their savings into investments quickly. Investing rapidly can be great if you happen to hit the bottom of the market, but if you do that nearer the top, then you may be in trouble. Spreading out purchases over time in a process called dollar-cost averaging is generally a better way to start. This way you’ll avoid the chance of quick losses across the board, and will have more opportunities to learn and adapt.

Home country bias: This is the tendency for investors to favour assets in their own country or region. Try to remember that the world is a big place, and it’s unlikely your country will consistently produce the best returns on the planet. It’s good to diversify where possible.

Trend chasing: Investing in hot trends can be rewarding, and is certainly attention-grabbing – and so trend-following is a common approach for new investors. This said, rookies often risk investing too much, and investigating or understanding too little. Many times, when hot trends turn, they fall fast and hard, and investors can lose in a big way. Strategies to help avoid or mitigate this risk include diversification and rebalancing (i.e. taking money from one sector and putting it in another).

Blind trust: I’m sorry to say that trusting the first financial advisor you meet could be a mistake. Sometimes they may just not be the right fit for you in terms of your preferred risk tolerance and strategies. As in other industries, they may not have your best interests at heart, or could be incompetent, disinterested, or just plain lazy. Instead of settling on an advisor after one meeting or phone call, shop around. Consider starting with a handful of advisors, and then whittle them down to a trusted team or individual. A good advisor should take the time to listen to you, and adjust based on your situation, preferences, and input.

Trading constantly: Rookies often love the rush of buying and selling, and it’s easy to get caught up in it! When it goes your way, investing can provide instant gratification much like gambling. Remember, though, that most brokers charge hefty trading fees that eat into your profits (in this, as in Vegas, the house always wins). In addition, you could end up paying more in taxes if you happen to be trading in a non-registered account. The lesson here is that inaction is often the best course of action. If you’re making small or even mid-size gains in frequent trades, make sure to assess your fees and taxes to understand if it’s worth it.

Using leverage: Even pros can blow up using leverage. For rookies, this is an even bigger risk – especially if it’s combined with some of the other common newbie mistakes mentioned here. Debt plus other mishaps is a powerful recipe for disaster. My mantra has become, “If in doubt, keep leverage out.”

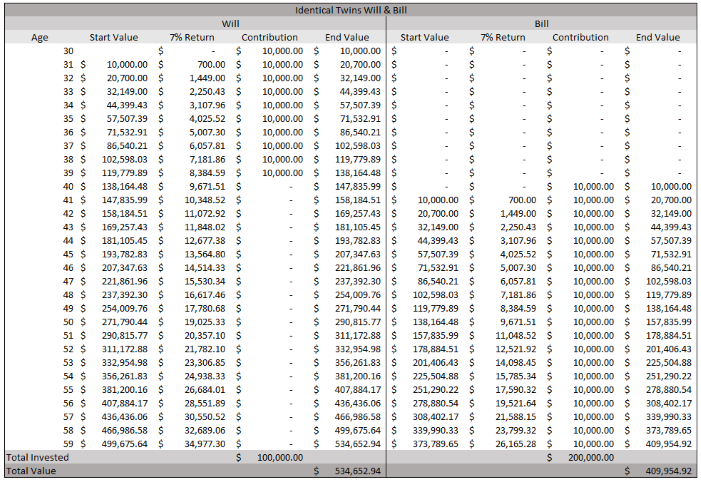

Not getting started: Take the case of identical twins Will and Bill. Both invest in the same fund producing an average 7% return per year. The difference? Will starts at age 30, contributing a total of $100,000 over 10 years. Meanwhile, Bill starts at 40, and contributes a total of $200,000 over 20 years. Even though Will invested half as much, he ends up with $534,652.94 after 30 years, while dear brother Bill has only $409,954.92. The lesson should be clear… GET STARTED! Even if you can spare only a sliver from each paycheque, compound interest means that it will grow substantially over time. (Remember, though – starting before you’re financially prepared in other areas still has worse consequences.)

Are you wondering how much Will would end up with had he continued contributing for another 20 years? The answer is a whopping $944,607.86 – and therefore the second lesson here is… DON’T STOP! Invest early and often, as long as you can do so without sacrificing other financial priorities.

Focusing on what to invest in instead of how to invest: If you focus solely on what to invest in, you might get lucky and win big once, but you could also fail and be put off. Alternatively, if you instead learn how to invest, you should be able to win repeatedly and reap lucrative rewards. This is essentially the investor’s version of the classic maxim, “Give a man a fish and feed him for a day; teach a man to fish and feed him for a lifetime.” Instead of getting lucky and picking one big fish, figure out how to reel them in consistently.

Not setting goals: Finally, many rookies simply don’t set goals. Your goals could be anything that’s important to you – buying a house in 5 years, funding a child’s education in 15 years, or retiring in 30 years. Regardless of the outcome you want, setting goals will help you determine how much risk you can take, and therefore where and how you should invest. After setting your goals, make sure to revisit them annually to ensure they still reflect your ambitions.

The list of risks could go on, but we’ve covered many of the most common, so for now we’ll leave it there.

Know Thyself: Explore Your Temperament & Bias

Investing is a personal endeavour, and it’s important to acknowledge that what works for one person may backfire for someone else. You may think do-it-yourself investing is the right fit for you, but learn over time that you’re actually happier working with an advisor. On the other hand, you may believe you’re best suited for passive investing, only to discover that you prefer stock picking. The trick is to find a strategy that aligns with your temperament. This will take time and experimentation, and probably some mistakes along the way.

The same applies to risks. You might think you can stomach a 40% correction, but then panic when actually confronted with the situation. Unfortunately, you just won’t know what adverse outcomes feel like and how you’ll react until you’ve experienced them. You will, however, know when an investment or strategy doesn’t work for you. It could keep you up at night or leave a knot in your stomach (and yes, I speak from experience). The solution for me has always been to sell whatever keeps me up. Over time my goal has become to pursue a strategy that lets me sleep at night, regardless of the ups and downs.

Everyone has built-in biases too. As you invest, you’ll need to confront your own cognitive and behavioural biases. We are generally overconfident, tend to anchor to irrelevant data points, or get mired in bad investments due to the sunk cost fallacy. The links in this paragraph provide a good primer on the topic. This article by Sherman Wealth Management on investor personality types is a good read as well. To recall another classic maxim, I like to remind myself that, “I have met the enemy, and they are me.” We are prone to self-sabotage in many aspects of life, and investing is no exception.

To make a long story short, when investing, strive to do what works best for you rather than others, get to know yourself as you experiment, and reflect regularly to uncover your biases.

Final Thoughts & Summary

Investing is a big topic. In this Investing for Beginners post, I try to cover the basics of building a strong foundation before beginning. Over the years, many people have asked me how to invest, and I invariably start by stressing the importance of getting personal finances in order. Investing seems exciting, but budgeting, eliminating debt, and building an emergency fund should take priority.

Once personal finances are in order, learning the lingo and reading about different investment philosophies and strategies is important preparation. The key point is that there is something out there for everyone – but your fit may look very different from what works for others. The trick to finding your fit is to recognize the risks, which can include taxes, inflation, volatility, and more, and then to determine your comfort level (with the goal of being able to sleep at night). Last but not least, I try to stress matching your approach to your temperament, and guarding against bias; try as we might, we are all biased, and need to recognize that we carry our biases with us into investing as well as into other areas in our lives.

If done correctly, investing should expand your mind and horizons while you increase your wealth and well-being. I hope this article provides you with a basic blueprint of how to begin, a primer on what to look out for, and some starting resources on where to turn when you need help. Good luck! Once you have these basics in place move read this post on how to Make the Most of Your Investments.

Disclaimer

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research, and seek out a professional who can work with you to reach your goals.

Thanks for the rundown on the terminology, Phil.

Some more advice I’d have for would-be investors is to avoid taking investing advice from popular media such as CNBC. Those sources are reactive and the market has already moved by the time news comes up.

One other point is that people should avoid magic, flashy trading strategies or brokers online. Those services are all designed to make money, not actually teach people how to invest. There are no quick wins in this game, and investors’ time would be better spent exploring the pros and cons of the options you listed in your blog post.

Also don’t invest emotionally. Don’t invest in sexy or meme companies like Tesla, or in highly speculative industries like green tech. Investment decisions should be a mechanical process that focuses on current market realities rather than idealism.

Thank you for reading and commenting Lewis, much appreciated! Good points about popular media outlets such as CNBC and avoiding magic trading strategies. I couldn’t agree more. As for investing emotionally, that is probably the hardest one to avoid and sadly the most important one to avoid.

This is a well thought out overview of a topic that covers such a wide breadth of material. Investing in an appropriate manner can sometimes seem boring, even if it’s the safest path to take. I like your discussion on emotional reactions and being able to stomach large or quick swings. It’s so true that most won’t know how they react until this actually happens and bad decisions are more often than not, the most likely result!

This is very good Phil. Read the whole thing…..again.

very informative article