Personal Finance in the News – May 2021:

Welcome to Money News – May 2021! Noteworthy news this month includes reflections on past inflation cycles, changes to the housing market with stricter stress tests starting June 1, and banks misplacing their clients’ money.

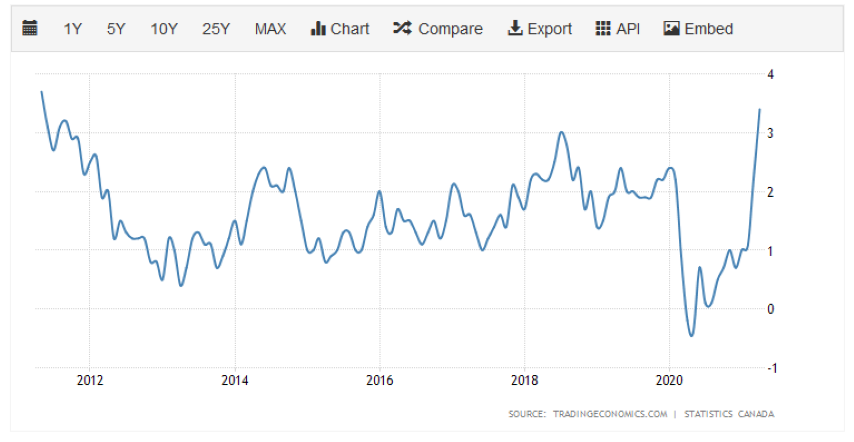

Read: A lot of people are talking about inflation after both US and Canadian inflation accelerated at its fastest pace in decades, and hit highs not seen in many years. The American consumer price index (CPI) leapt to 4.2%, and Canadian CPI jumped to 3.4%; these readings were significantly above analyst forecasts. The last time North America faced serious inflation was during the late-1960s to the mid-1980s. In this CBC article, Don Pittis talks to professor emeritus David Laidler of Western University. David had a front row seat to these past inflationary years.

Read & Watch: The Office of the Superintendent of Financial Institutions (OSFI) is about to modify the so-called “mortgage stress test.” Starting June 1, the minimum qualifying rate for an uninsured mortgage will increase to the greater of the mortgage’s interest rate +2%, or 5.25%. This may moderate housing price pressure because it will reduce the amount of debt home buyers can qualify for. Time will tell though, as so far, the government’s demand-side measures have failed repeatedly.

Read: Two recent stories in the news focus on Canadian banks misplacing a client’s money. First, this CBC article tackles the tale of TD Bank losing a customer’s RSPs after they opened an account in the 1990s and then moved to New Zealand. While fault is firmly with the bank, there’s a good lesson here to stay on top of your accounts. Downloading statements once a month or quarter is a good habit that should do the trick. Second, this Toronto Star article examines how a client’s digital transfer was sent by mail (no joke) and got lost. It is less clear what the lesson is here, aside from keeping well on top of your dear bank. Stories like these may help to explain why satisfaction with Canada’s banks has dropped, according to this Canadian Press article.

Stay tuned for more Money News next month, or check out my recent post on Housing Market Solutions. While most articles on this site focus on personal finance, this article takes a look at Canada’s red-hot real estate market. It also proposes a few potential remedies.

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.