Personal Finance in the News – December 2020:

Welcome to Money News – December 2020! I have four noteworthy topics for you this month.

Read: The era of low interest rates and high real estate prices continues. This month, HSBC offered a mortgage rate below 1%. This is a first in Canada, and a record low. Though rates could still go lower and in Denmark there are even negative interest rate mortgages, it’s hard to imagine much cheaper debt-financing options.

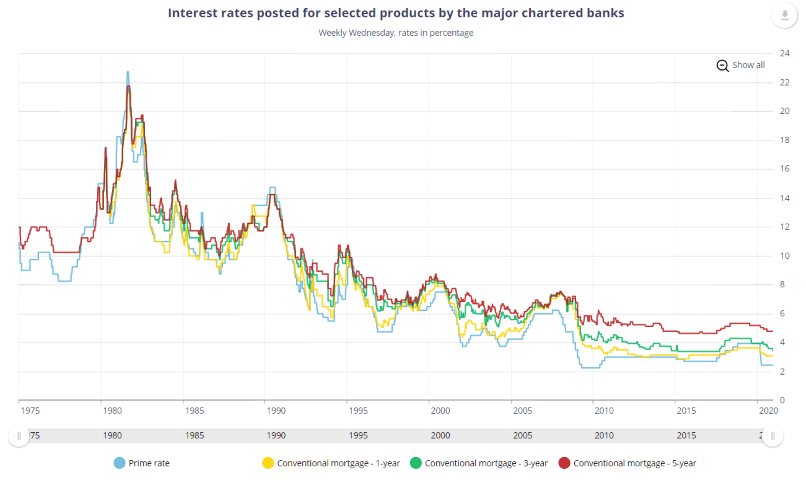

Read: Record low mortgage rates aren’t confined to just one bank, however. The Bank of Canada chart above highlights how low rates are versus the long-term average – let alone the 1980s. Back then rates on some mortgages reached over 20%!

Read & Watch: According to a recent BMO survey, cash is the primary investment in most Tax-Free Savings Accounts (TFSA). This is incredibly unfortunate as TFSAs are an excellent vehicle in which to invest in stocks and other assets that can grow significantly over time and remain tax-protected. The Tax-Free Savings Account should really be renamed the Tax-Free Investment Account or TFIA. This way it would encourage people to use it in this way to their best advantage.

Read: Meanwhile, confusion and anger over the Canada Emergency Response Benefit (CERB) continues. Though it is certainly possible there are fraudulent claims at play as well, many self-employed Canadians are now being asked to repay sums of up to $14,000. This seems to be a result of unclear wording regarding gross vs. net income on the original application, and genuine misunderstandings on the part of applicants as well as many professionals who provided advice.

That’s all for now – thanks for reading Money News – December 2020 edition! Stay tuned for more money news next month. In the meantime, check out my latest post on my annual financial review and goal setting process.

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.