Personal Finance in the News – August 2021:

Welcome to Money News – August 2021! Noteworthy news this month includes an overview of how each political party plans to address housing affordability if elected. Plus articles on zero cost trading commissions coming to Canada, and the stock market experiencing its fastest rally ever.

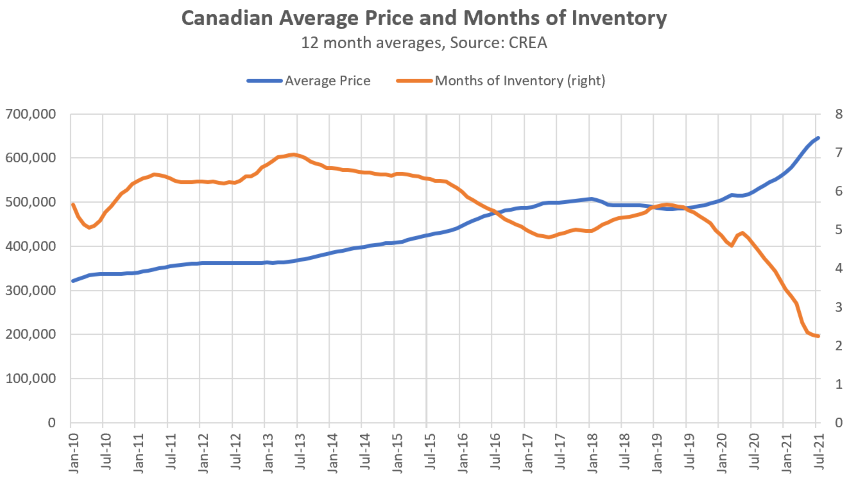

Read: Canada’s elections are in full swing, and housing affordability has become a key issue for voters. This is hardly surprising given the state of Canada’s housing market today. As the graphic above illustrates, the average home price in this country has more than doubled over the last decade. During this same period, the months of inventory available on the secondary market has cratered to a record low. In this House Hunt Victoria post, Leo Spalteholz compares each party’s platform, summarizes the supply and demand measures they are proposing, and discusses what is missing.

Read: According to this Globe & Mail article, National Bank has slashed its brokerage trading commissions to $0.00. Will competitors match them to retain clients? In all likelihood, yes, and that is good news for Canadian investors. This is because it will keep more money in their pockets. Many American firms have offered $0.00 commissions for a few years now. Its glad to see we’re finally catching up.

Read: Sticking with the stock market, this CNBC article recounts how crazy the past 18 months have been for investors. Following the fastest bear market collapse of over 30% on record, the S&P 500 has now doubled from its pandemic bottom, making it the quickest bull market rally since World War II. While swings of this speed and scale are unusual, they highlight how volatile markets can be. Moreover, it highlights the importance of accepting if not embracing and benefiting from the swings.

Read: If you’ve ever wondered how much severance you’re entitled to when you’re fired, apparently you are not alone. In this Financial Post article, Howard Levitt discusses this topic and why it’s tough to get a hard and fast number.

Read: Many people working from home may be wondering, “What do I need to know if the CRA reviews my home office expenses?” Fortunately, the Financial Post has you covered and discusses this question in detail.

Stay tuned for more Money News next month. If you’re new to M$M check out my keystone post here or read articles on personal finance here. Thanks for reading!

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.