This blog post details how I go about tracking my spending, and why it’s important. Do you know how much you spend? It may be more than you think. Once you’re done, check out the Building a Budget post that goes along with this topic.

Why is Tracking My Spending Important?

Tracking your spending lets you see how much money you’re burning between each paycheque, and helps you see where your money really goes. Once you’ve tracked your spending for a few months, you should be able to build a realistic budget based on your actual spending and needs. From there you can think about how to modify your habits if you want to save more.

Above all, the act of tracking your expenses will give you an awareness of how you truly spend your money. This extra consciousness can have the side effect of a bit more financial conscience too – like a little Jiminy Cricket on your shoulder, but with a calculator. Remember that old saying, “What gets measured gets managed”?

No matter what your finances are like today, they can probably be improved by tracking your spending each month.

How Do You Track Your Spending?

In practice, there are lots of different ways to track your spending. Some banks and credit cards provide built-in expense tracking functions for your online accounts. This usually works best if you do most or all of your spending from that one account. There are also dozens of purpose-built apps out there – this article “The 7 Best Expense Tracker Apps of 2019” reviews some of the most popular ones.

I’ve also met people who put pencil to paper and do it by hand. Yes, this is pretty old school, and seems like a lot of work, but it’s also very hands-on. I think this method likely makes your spending much more tangible than having an app automatically record it with little or no personal effort. If budgets never really feel real to you, or if you’ve tried and failed a couple times in the past, maybe give this way a shot.

Personally, I use Excel. It is easy to use (really!) and very customizable. For me, it’s still hands-on enough to have my spending feel real, but it’s also automated enough so that I can quickly get a summary of how I’m doing, or how much I’m spending in different categories like groceries or restaurants. Moreover, it also means I keep my personal financial data private instead of implicitly handing it over to a company operating an app.

You can find a copy of the Excel sheet I use on the Free Financial Resources tab. It covers how to track spending, income, as well as build a budget and calculate an appropriate emergency fund.

If you’re just starting out, the most important thing is to be consistent. Once you’ve tracked it for a few months, you’ll have an idea of what your average spending is, and many months of data will smooth out the impact of infrequent but big-ticket items like annual property tax or insurance payments.

When do You Track It?

I try to make a habit of entering my spending in Excel every time I get home from shopping or going out – so I don’t forget. This is especially important if I buy something with cash, as then I don’t have a credit card statement to cross-reference. At the end of every month, I review my expenses, and then add the total to my annual income statement.

Now What?

You may be wondering what you do after you’ve started tracking your spending. The answer is – build a budget! Then, if you want to save more or need to make other adjustments, take a closer look and see where you can make cuts without sacrificing what matters to you. Hopefully this will help you increase your savings! If you’re ready for this next step, check out my series on Building a Budget.

Final thoughts:

If you want to get a grasp on where you’re spending or increase your saving, start by tracking your expenses, and then build a budget. This will let you see where your money’s going, and that can give you a larger idea of where your finances are headed in the future. Tracking your spending doesn’t need to be complicated. For example, you can do it yourself in Excel, download an app, or see if your bank has a program to do it automatically – or even just write it down. Once you’ve got in the habit of expense tracking, you’ll be able to build a budget, establish an emergency fund, and set savings goals.

You can find a copy of the Excel template I use here.

If you’re still wondering how tracking my spending fits into overall finances check out my original post: Seven Financial Rules I Live By and consider subscribing too.

Disclaimer:

Please keep in mind I am not a financial advisor and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.

I used to track expenses manually, then automated it via an app (mint). I have to say, it felt more real tracking expenses manually and the additional touchpoints of looking at the budget, made me think about it a bit more. By automating, it is more convenient, but I notice myself looking at my budget much more infrequently.

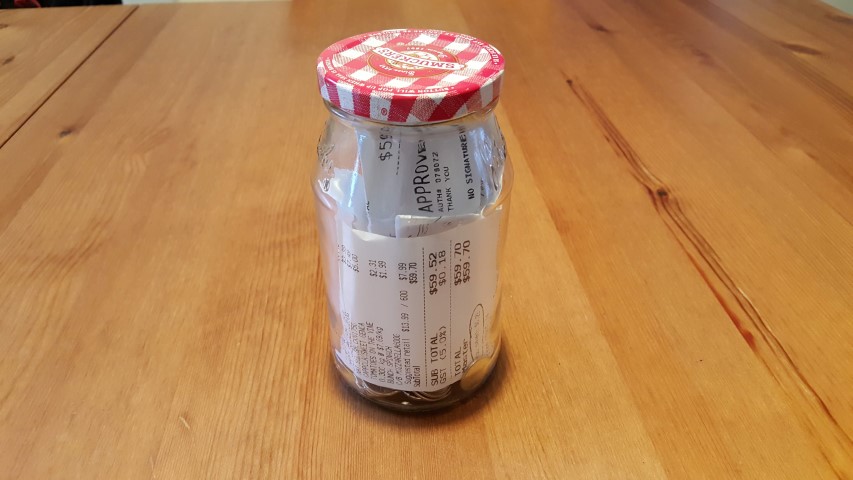

When we tracked manually, we saved receipts after every purchase, and took some time over a weekend to enter it all in our spreadsheet. That worked better for us.

Thank you Abhinav. It certainly is a trade off between tracking spending automatically via an app like Mint versus doing it manually in Excel or elsewhere. I think you’ve provided a great summary of these pros and cons here. Thanks!

This is an excellent way to track your spending and I know that it’s essential to track your spending. My friends don’t track their spendings, so I am going to share this post with them now. Hopefully, they’ll start tracking their spending.

Thank you Greg, I’m glad you found this article useful and tracking spending method useful. Much appreciated.