Introduction

How do you make the most of your investments? Once you’ve mastered the basics, this is the next big question. In my experience, there are four main areas to consider to maximize your investments. This is true regardless of whether you’re a DIY investor or working with a financial advisor. In this article, we’ll take a look at all four of these elements, and rank them in order of importance.

Before we begin, keep in mind that this article is a follow-up on my recent post Investing for Beginners. If you’re new to investing, I recommend you give it a read before moving on. It’s extremely important to understand the basic concepts first, as well as the differences between passive and active investing. Perhaps most of all, it is critical to understand how to build a portfolio to address the impacts of taxation, inflation, and volatility before tackling the four questions below.

Big Question #1: What securities should I own?

The number one way to make the most of your investments is to figure out which securities you should own. If you have a professional managing your money, they should be able to explain their rationale for anything they are purchasing for you. If you want to quiz them, do a little digging into their suggestions, and try to get a sense of the securities valuations, financial health, and overall outlook for the company. It also makes sense to check in with your advisor semi-regularly. Once a year, for example, you should reassess your portfolio, rebalance the positions if needed, and make sure your investments are still working towards your identified goals.

If you’re a DIY investor, your research process should identify which securities you want to own. If it’s not doing that, you need to adjust your valuation system and re-think what makes a good investment.

Many times, the securities you own will depend on your strategy. For example, some people are focused on growth stocks, and are looking for capital appreciation, while others may look for steady income or dividends instead. Still others only ever invest in bonds or fixed income. Fortunately, there are strategies out there for everyone – from buy-and-hold forever and value investing, to growth investing and day-trading.

No matter what strategy and securities you pick, make sure your method is something you can stick with through market panics. Your strategy is only as good as your stomach. If you’re just starting out, it might take time before you know which strategy you can handle, so proceed carefully. For an overview of different strategies check, out Investopedia, or read this article.

Big Question #2: How much should I invest?

Once you’ve determined what securities you want to own, you need to figure out how much you want to invest in each opportunity. In poker, figuring out how much to wager is called bet sizing. Good poker players (and investors) need to make an educated guess as to how much they can risk placing on any given bet. The key here is to make sure that no investment is so big that failure will blow up your portfolio, and that no investment is so small that it fails to move the needle for you if it excels.

As long as you fall into the middle of this range (avoiding destroying your portfolio and also avoiding investments so small as to be meaningless), there is really no wrong way to “bet size” in your portfolio. You could ease into a position slowly, and then increase your stake as a company proves itself to you. You could weight every investment you make equally no matter what. Alternatively, you could let your research process determine how much you want to put into a given company – that is, if your research suggests it’s a screaming buy, load up, or if it appears only slightly undervalued, take a smaller stake. A word to the wise though – be careful if you are “loading up”. Investors commonly believe their research process is much better than it actually turns out to be in action.

The bottom line is to remember not to bet the farm, but don’t make hundreds of insignificant bets either. When I make an investment personally, I tend to commit a minimum of at least two percent of my portfolio to the name. On the high end, I also tend to scale back if a position ever equals more than 12% to 13% of my capital. The same goes for exposure to a sector or industry – if it’s ever more than a quarter of my portfolio, I start to feel uncomfortable and will rebalance. This is based on personal preference, and the ratios will look different for everyone.

Big Question #3: What percent of my portfolio should I hold in cash?

Figuring out how much cash to hold is the next big question to tackle. Holding too much cash in your portfolio during up markets will dampen your returns. On the other hand, holding too little cash in down markets will increase portfolio volatility and could prevent you from loading up if you find opportunities at depressed prices. The balance you’re looking for here is one that allows you to reduce drag in up markets, but also to maximize your opportunities when markets are down.

This can be really hard! As a result, some DIY investors and professionals will never hold cash, and instead choose to be fully invested come rain or shine. There’s nothing wrong with this approach, but it takes an iron stomach to stick with it when recessions hit. Other investors may choose to use options, or to create a long/short portfolio instead of holding cash. This can be a good approach for some too, though it takes considerable babysitting, and going short on a stock or ETF can be very risky.

Personally, I always hold some cash, with the amount varying depending on market conditions. Each quarter, I review many metrics to assess how much cash I should hold. Generally, if investor optimism is hot, the economy is booming, and corporate insiders are selling, I will increase my cash. This tends to happen naturally in an up market, as fewer stocks will look cheap, and the investments I hold will start to hit my sell targets, bringing cash back into my portfolio. On the flip side, if investors are scared, the economy is in recession, and insiders are buying, I will often start to deploy my cash. This too often happens naturally, as formerly expensive stocks become cheap again. This method is far from perfect, but has still helped my returns over time because it prompts me to deploy my cash near market bottoms, and to save it near market tops.

One final note on cash for the DIY investor – when it comes to determining your portfolio’s cash level, you may want to hold less cash in accounts where you regularly contribute some of your paycheque. This is because paycheque contributions serve the same function as cash already in the account, and can similarly provide you with the ammunition necessary to buy securities in the future. Please note, this ONLY applies if you have a steady income that allows for it, and if you are disciplined enough to consistently contribute to your investment accounts. Don’t do this if you’ve never been able to set up an automatic savings plan.

If you have a professional investing for you, you will want to be familiar with their cash philosophy. Are they going to be fully invested, do they short, or are they going to hold some of your portfolio in cash? Knowing this may influence how much cash you keep outside of their management. If, for example, they’re going to hold cash, you may not want to also keep a surplus in your regular bank account. Alternatively, if they intend to always fully invest, you may want to hold some cash yourself just in case.

The overall goal here is simple: no matter what you choose to do, make sure you’re comfortable with it. You always want to sleep at night! You want to make sure that your portfolio is positioned for success, and that you won’t be kicking yourself later for either losing a lot of money all at once, or missing out on a great opportunity due to lack of liquidity.

Big Question #4: What currencies should I hold?

The final way you can make the most of your investments is to determine which currency you want to use when investing. If you are an American investor, this may not be important to you. America is home to the world’s largest financial markets, and thus not only do American markets expose investors to domestic opportunities, but many international securities also list in the US. To make a long story short, if you’re an American investor, you probably don’t think about exchange rates much.

As a Canadian, however, I am regularly thinking about what currency I want to be invested in. Do I bias towards owning more Canadian Dollars, or do I buy the US Dollar? Some investors solve this problem by hedging their currency exposure, or by purchasing currency-hedged ETFs listed in Canada. Other investors become full-time currency traders and make this investment niche their home.

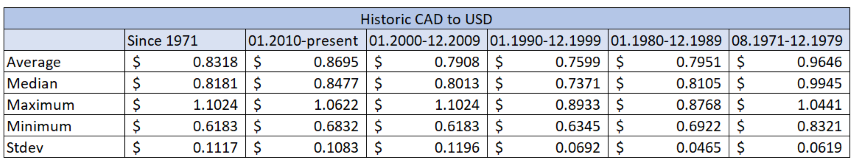

Personally, I adjust how much of my portfolio I may be holding in USD or Canadian Dollars based on where that relationship is sitting versus its long-term average. In the early 1970s, the US abandoned the gold standard, which ended a period wherein the US would convert its currency into gold at a fixed value. Since then, global currencies have oscillated versus one another more freely. You can find this data in many places (the Bank of Canada, OFX.com, and fxtop.com are some good resources).

At the end of each year, I update an Excel document I use to track this relationship. As you can see, the CAD/USD exchange often sits between $0.79 to $0.87. If the CAD/USD is trading in this range, I will happily convert currency either way without worrying about it.

You will notice this relationship has extremes as well – trading as high as $1.102 and as low as $0.618. At times when the CAD is well above its average range, or is approaching the high end of the spectrum, I will consider converting a lot of my Loonies to USD. On the other hand, I’d be looking at converting much of my USD back into CAD if the Loonie is looking low. However, one important note here is that I will not actually go ahead with converting currencies if what I’m going into has inferior investment opportunities available. In other words, picking the right securities takes precedence over the exchange rates.

This strategy works for me personally, but again, it’s far from perfect. This currency question is another reason why some investors hedge, and others use hedged-products. Moreover, past returns are not indicative of future performance. This relationship may very well break down in the future. The strategy is also blind to the power of momentum. Currencies that look undervalued can become more undervalued before turning the corner, just as overvalued currencies can build on their strength. Finally, currencies can be overvalued or undervalued for years, which can test the patience of investors looking to convert currency. All this being said, it’s still important to be aware of exchange rates and keep them in mind. No matter what approach you take, thinking about this should help you squeeze a little extra out of your portfolio, and make the most of your investments.

Final Thoughts & Summary

Learning how to make the most of your investments is critical to good performance – once you’ve mastered the basics, of course. In my experience, there are four questions you want to answer in order to make the most of your investments. To recap (in order of importance), ask yourself, “What securities should I own? How much should I invest? What percent of my portfolio should I hold in cash? And finally, what currencies should I hold?”

Answering these questions is important for any investor, regardless of whether you choose a DIY approach or have a professional investing for you. Considering these factors is also a never-ending challenge. Markets are in a constant state of flux, making investing the greatest real time strategy game out there. However, by keeping these four elements in mind, and regularly reviewing to make sure you are aligning your investment approach with your answers to these questions, you should be able to make the most of your investments. I hope this article serves you well.

Thank you for reading! If you have found this useful but want to start smaller, check out Investing for Beginners, or take a further step back and see how investing fits into a bigger financial picture by reading the Seven Financial Rules I Live By.

Disclaimer

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research, and seek out a professional who can work with you to reach your goals.