Personal Finance in the News – October 2020:

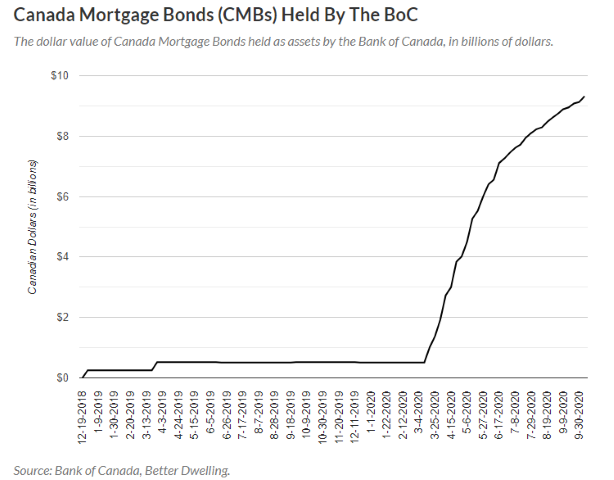

Read: The Bank of Canada has ended a pandemic program that helped real estate prices surge. This largely unknown but wide-reaching policy saw the Bank of Canada buy nearly $10 billions in mortgage bonds. This artificially lowered borrowing costs and helped send home prices through the roof. What happens now is anyone’s guess, but the consequences of government bodies and public institutions attempting to influence market prices are often severe, and can be hard to recognize.

Read & Watch: Speaking of housing, the mortgage deferral program launched as Covid-19 took off in the spring is now coming to an end too. This BNN-Bloomberg interview with Pattie Lovett-Reid looks at five considerations for those still in the program who may need a little extra help with their mortgage debt.

Read: The Canada Emergency Benefit Program (CERB) has ended, but has been replaced with the Canada Recovery Benefit (CRB). Unfortunately, there appears to be a lot of confusion regarding these changes. Those who are struggling with the changeover can find more details here.

Watch: For those looking for something a little different, Economics Explained offers an interesting YouTube video exploring the wealth gap between different generations, including Baby Boomers, Gen X, and Millennials.

That’s all for now – thanks for reading Money News – October 2020 edition, and Happy Halloween! Stay tuned for more money news next month. In the meantime, check out my latest posts on writing a will and power of attorney. You can also visit my keystone post on basic financial rules.

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.