Personal Finance in the News – April 2020:

Here is a summary of April 2020’s Money News. As you can guess, COVID-19 and the global health crisis continue to dominate everything, including personal finance.

Read: Many families have been deferring their mortgage payments as layoffs mount and the recession bites. As of early April, almost 500,000 Canadians had requested mortgage deferrals according to BNN-Bloomberg. This article by the Toronto Star discusses some of the unpleasant side effects it may have on your credit score.

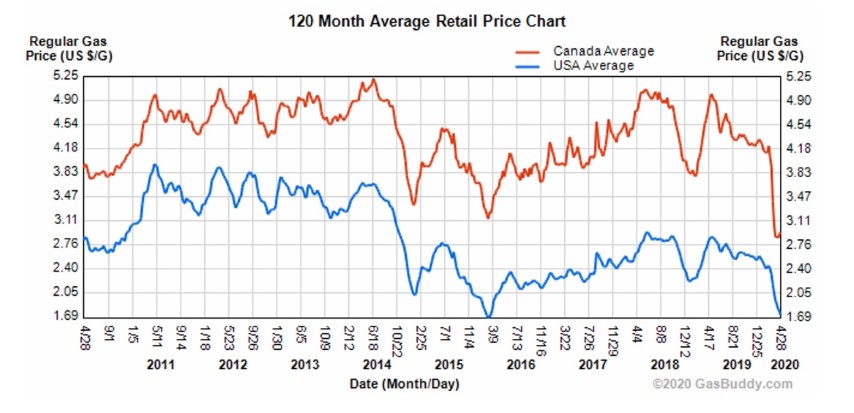

Read: For the first time ever, the price of oil collapsed below $0.00 in the United States. Though the price recovered and the reasons for the drop are complex, prices around the world remain low. As a consumer, this may be helpful. North American gas prices are falling to 10-year lows. The graphic above by GasBuddy illustrates this point nicely.

Read: With borders closed, flights cancelled, and cruises on the back burner, you may be wondering about your travel cards and points. Family Money Saver discusses all things travel rewards for those of you wondering about travel, COVID-19, and what to do with your accumulated travel points.

Read: There is a lot of information and misinformation regarding government programs out there. Going straight to the source is probably the best way to resolve any confusion. Here are the federal governments’ links to the economic response plans for Canada, the United States, and the United Kingdom. In addition to using these sources, visiting provincial, state, and municipal government websites may also provide clarity on what programs are in your area.

Read: Governments are attempting to reduce financial pressure on small businesses too. In the United States, the “Payroll Protection Program” has been replenished with another roughly $300 billion. The first tranche ran out in less than two weeks. Meanwhile, in Canada, the federal government is implementing rent relief for businesses through a loan program that may cover up to 85% of commercial rent costs.

Thank you for reading April 2020’s Money News. Stay tuned for more blog posts and monthly money news in May and beyond. In the meantime, check out my latest blog posts about how to live on less, and about the financial steps my partner and I have taken in response to the global pandemic.

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.

I’ve wondered as well if people are aware of the potential implications on their Credit Scores deferring mortgage payments might have. Good link! I’m also wondering if this will be the case with municipal tax deferrals as well, as many seem to have given a deferral option of two months.