Personal Finance in the News – March 2020:

March 2020’s Money News is here! As the global health crisis goes from bad to worse, the economic costs are piling up and spilling over into significant financial hardship.

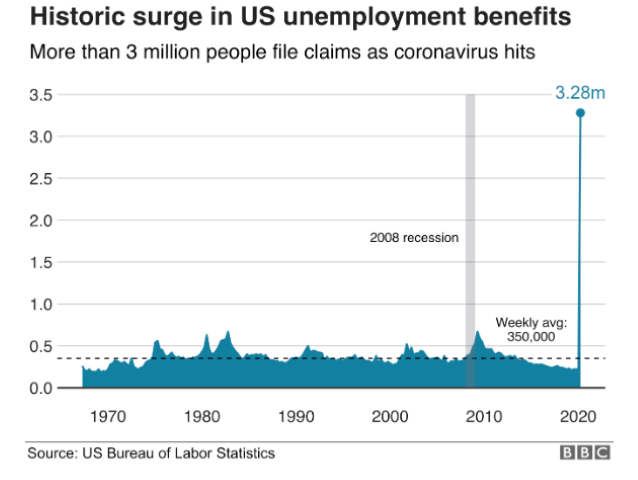

Read: The US and Canada have reported their largest weekly initial unemployment claims ever at 3,280,000 and 929,000 respectively. For perspective, the previous American high was 695,000 in October 1982 and the prior Canadian record was 499,213, set in December 1957. In the coming weeks, this may get worse as shutdowns expand or become more restrictive.

Read & Watch: Speaking of big numbers, America is in the process of passing a $2 trillion stimulus package, and Canada has passed a $82 billion support package to help families and businesses survive what many hope will be a temporary shock.

Read & Watch: Though options differ as to the exact definitions of a recession or a depression, many people are talking about both these days, and wondering what we might be in for given the scale of the current health crisis and its economic fallout. These resources by Forbes, the balance, and CNN offer their takes.

Read: Canada and the US have both cut interest rates back to Great Recession levels of 0.25%. While taking on debt is probably not a good idea at this point, it will lower borrowing costs for some consumers and businesses. This may give those who are able to refinance an opportunity to lower their costs.

Read: If you’re in need of some quick cash, the CRA is sitting on about $1 billion in uncashed cheques. To find out if one of those cheques may be yours read this article by the National Post. Every little bit helps!

Thank you for reading March 2020’s Money News. I hope you and your family stay safe and healthy during this crisis. This coming month I may write a few blog posts related to the economic impacts of the unfolding health crisis and provide details regarding various programs set up to help ease the burden. In the meantime, you can check out my latest blog post on the personal financial steps my partner and I have taken due to the global pandemic over here.

Disclaimer:

Please keep in mind that I am not a financial advisor, and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.