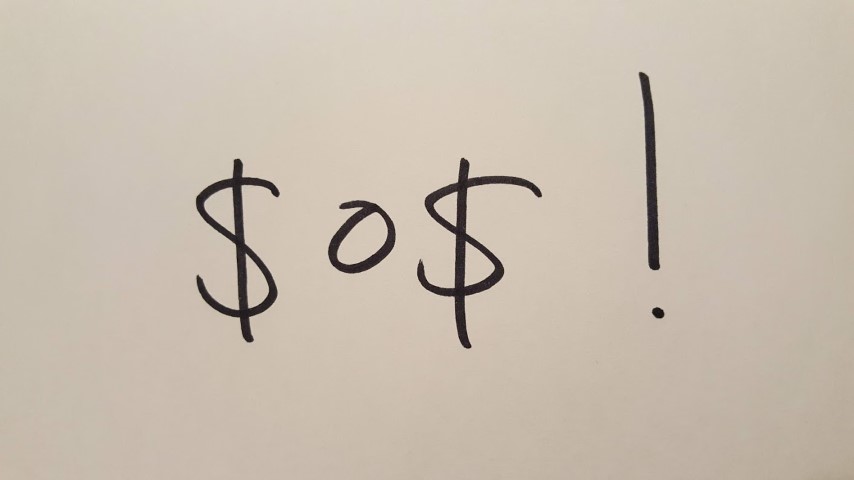

What is a financial emergency fund?

A financial emergency fund is cash you’ve stashed away in case of unexpected expenses. It’s often the first line of defense in your financial safety net, and you can also use it as a source of money to pursue opportunities when they arise.

Why is an emergency fund important?

There is no telling what life will bring. Maybe you and your partner will have twins when you were expecting one, or maybe an exciting opportunity will appear out of the blue. Other times you may lose your job, be injured in an accident, or fall ill. Looking after a loved one could also take a toll on your finances. Even when healthy and working, you could still face unexpected costs – related to your home, car, pet, or any number of other surprises!

Sometimes people without an emergency fund turn to credit cards, lines of credit, or other forms of debt. Unfortunately, this has the potential of turning a short-term emergency into a long-term crisis.

Financial emergency funds are even more important if you carry ongoing debt like a mortgage, car payment, or student loan. This is because payments often need to continue regardless of your situation, and if you can’t keep up then you’ll incur even more debt in interest fees, or even run the risk of defaulting.

Combined, these reasons are why I consider my emergency fund to be the bedrock of my personal financial planning. Furthermore, it one of the Seven Financial Rules I Live By.

It is also a reason why I’ve included an budget Excel file in Free Financial Resources. This file can help you track your income and spending. From there you can build an accurate budget and (you guessed it) an emergency fund.

What about investments?

If you’re an investor, having an emergency funds can help you protect your other assets too. Sometimes people without emergency funds are forced to sell investments to cover expenses, but this can really hurt if the stock market is down and you need to sell before you planned. It could also sting in the future if the sold investments go on to perform super well.

Check out Investing for Beginners for more on the topic of investing.

How big should an emergency fund be?

There isn’t a hard rule for how much money should be in an emergency fund – it comes down to what you’re comfortable with. Some people are happy with a fund that only covers three months’ worth of regular expenses; other people may want to cover six months, 12 months, or even more. Personally, I like about a year’s worth tucked away. Nevertheless, it’s ultimately up to you – even a small amount of savings tucked away in case of emergency is better than nothing.

In the past, I’ve needed to eat into my financial emergency fund a few times, and it’s done its job perfectly. More importantly, after the unexpected expense has passed, I always work on topping it up again before moving onto other money goals. This way I’m ready if another crisis comes up, and I feel confident knowing I have a bit of a cushion to fall back on, just in case.

Where do I keep it?

There are many places you could put emergency cash. Personally, I keep mine at a bank – though not in my day-to-day account (or even at my regular bank), because I don’t want to spend it accidently, or get it mixed up with money for other things. I also want it to make me some interest! Therefore, I keep my emergency fund in a separate high interest bank account, where it earns some money, I can’t spend it accidently, and where it’s easy to transfer to another account in a pinch.

Final thoughts:

Having a financial emergency fund brings my partner and I peace of mind, and it helps us reduce our background stress. Our emergency fund is the foundation on which the rest of our financial goals are built. Moreover, it has allowed us to address unexpected challenges without going into debt.

Click on this Free Financial Resources tab to find the “Income-Budget-Spending-Emergency-Fund” Excel sheet. It can help you calculate how big your emergency fund should be. Please subscribe and stay tuned for more articles like this in the future.

Disclaimer:

Please keep in mind I am not a financial advisor and the opinions expressed are my own. My Money Moves does not provide financial advice – it is an informational website that details my own approach to my own money and personal finances. If you need specific financial help or guidance, please do your own research and seek out a professional who can work with you to reach your goals.